Making responsible investment choices can make a positive difference for your family, the world and your pocketbook.

As a parent, the list of responsibilities can be endless. Amid trying to manage all the tasks needed to keep kids healthy and safe, planning for their future and for future generations may seem like it can wait. But in order to help ensure that our children and our children’s children will inherit a world we’re proud to pass down, it’s imperative to act now.

It’s easy to feel powerless when it comes to big issues like climate change. But the truth is, we can each make a difference—even a small one—if we simply take action. One way to do so is through responsible investing. You can help drive positive change by investing in companies working to have a positive social impact.

What is responsible investing?

Put simply, responsible or sustainable investing is considering both financial return, and environmental, social and governance (ESG) insights when making investment decisions. According to RBC InvestEase, this form of investing recognizes that companies solving the world’s biggest challenges may be best positioned for growth and all-in-all helps pioneer better ways of doing business to create a more sustainable future.

Many of us are becoming familiar with ESG factors like carbon emissions, customer satisfaction, diversity and labour standards, and business ethics when it comes to deciding who or what to invest in. It’s important to also look at which companies actually address environmental problems–those that make products and services that drive the energy transition from fossil fuels to alternative and clean technology, and not simply those cutting emissions while still producing unsustainable products.

By considering such factors, you can make a meaningful contribution to a sustainable future and your investment portfolio. There are sound financial reasons to invest in these types of funds–it’s not about sacrificing performance for purpose. You can do good and make money. Responsible investing can act as a positive societal force by directing more investment dollars to those companies that perform well on ESG measures and impacts.

How do I choose what to invest in?

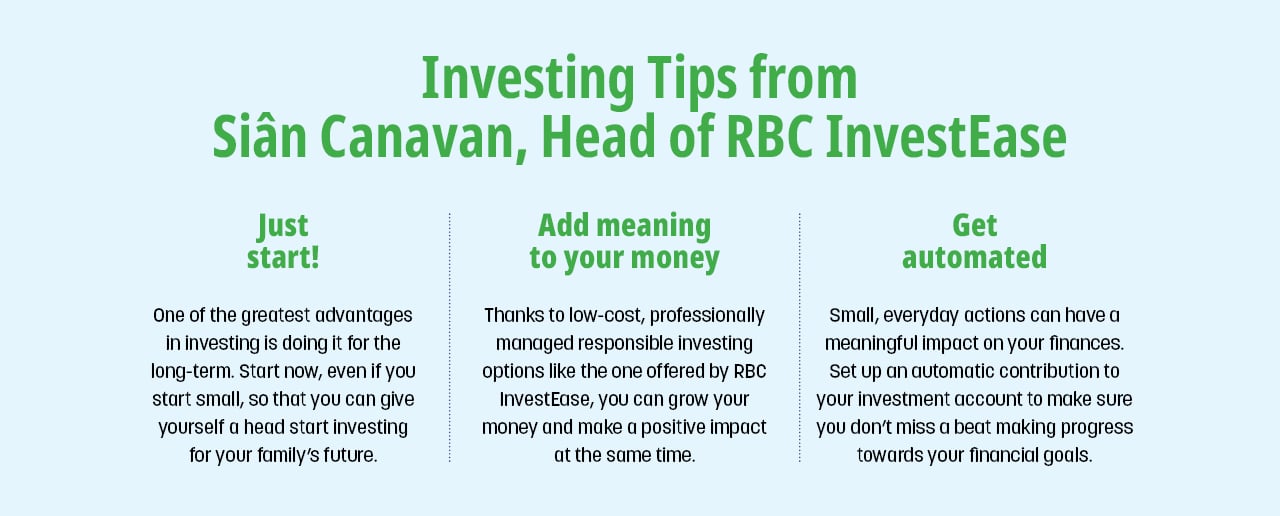

For many busy parents, sussing out which responsible investment products to choose can involve more time and expertise than they may have. That’s where it makes sense to seek out an easy solution, like RBC InvestEase, that is designed to align with your goals and comfort level and is professionally managed by portfolio advisors.

Consider sustainable portfolios that are cost-efficient, globally-diversified and professionally managed–just as you would for any other investment portfolio. The difference is that the consideration of ESG factors is explicitly incorporated into the investment decision-making process. For instance, RBC InvestEase portfolios avoid companies in industries with high ESG risks (such as those involved with controversial weapons or tobacco).

How can I involve my kids?

Parents make the best role models so when we demonstrate how our actions matter, kids can feel empowered to do the same.

It can involve simple tasks like choosing more plant-based foods that produce less carbon, using a push mower to mow the lawn–or better yet, replacing the lawn entirely with native plants that require less water and don’t need to be mowed, and sealing up cracks around windows and doors to reduce energy needed for heating and cooling.

Talk to your kids about your values and how that can influence everything we do, such as how we treat one another and the products we buy, including our investments. Making more responsible choices in our day-to-day living, as well as longer-term decisions such as investing, teaches our kids about how we can make a difference in the world.

Visit RBC InvestEase to learn more about responsible investing.